10 Critical Startup Red Flags 🚩 You Must Watch Out For

I spent 100 grueling hours researching startup failures so you don't have to. Here's what you need to know.

Hey there, product enthusiasts! 👋

Welcome back to another edition of our newsletter. I'm Akshay Pruthi, ready to dig into the ruins of failed startups and unearth some priceless lessons.

Today, we're going on an archaeological expedition through the graveyard of failed products. Don't worry, it's not as gloomy as it sounds! In fact, it's a goldmine of insights that could save your startup from becoming the next extinct species.🦖

By the end of this newsletter, you'll understand:

The top 10 reasons startups fail (and how to avoid them)

Strategies for startup survival (or how not to become a fossil)

Frameworks for startup success (your toolkit for this adventure)

Ready to dust off your fedora and grab your whip? Let's dive in!

The Top 10 Reasons Startups Fail: A Comprehensive Survival Guide

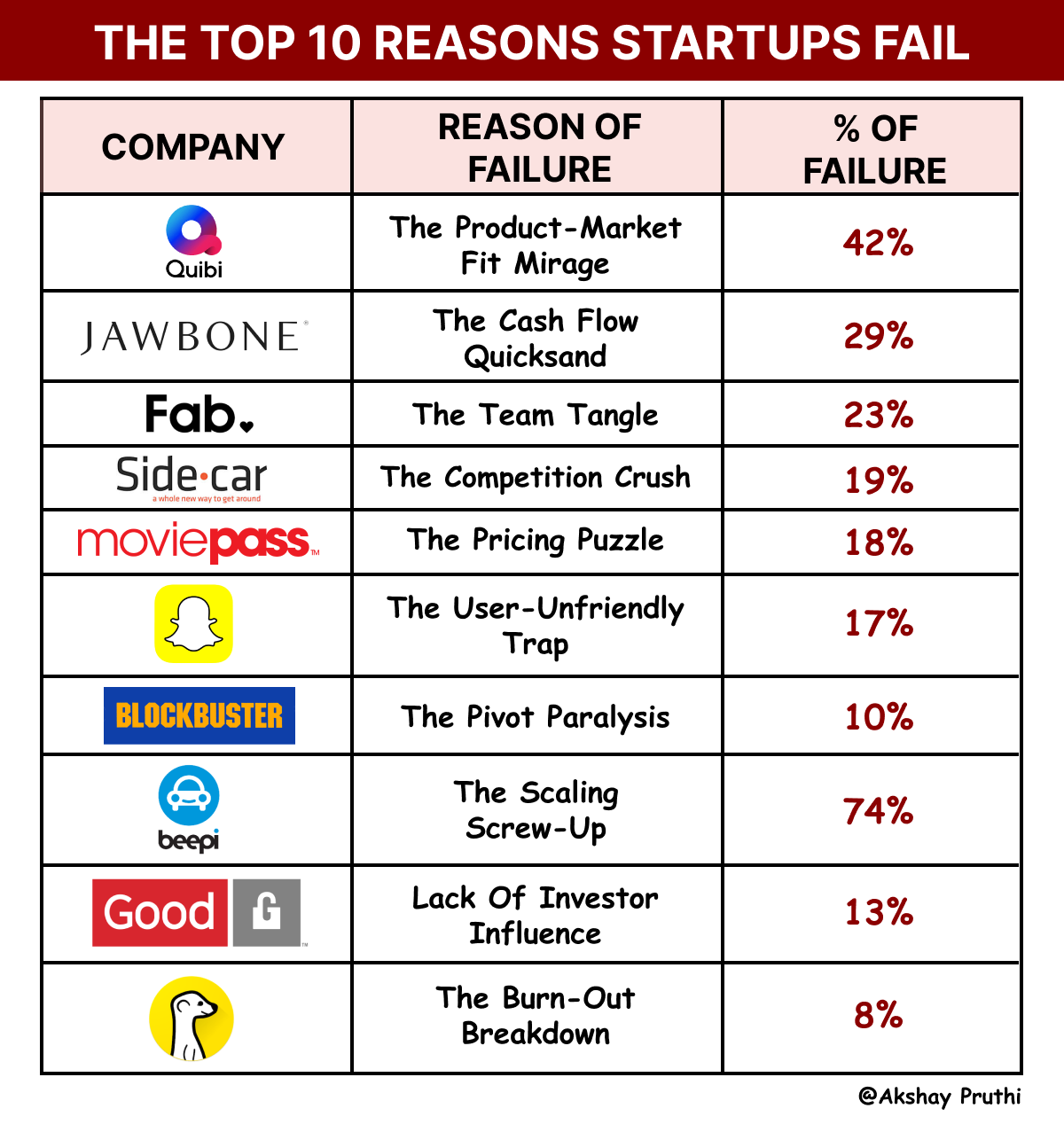

1. The Product-Market Fit Mirage (42% of failures) 🏜️

Product-Market Fit (PMF) is often described as the holy grail of startups. It's the degree to which a product satisfies a strong market demand. However, many startups fall into the trap of believing they've achieved PMF when they haven't. Let's explore the top 3 mirages of Product-Market Fit:

The Echo Chamber Mirage: This occurs when founders mistake positive feedback from their immediate network for genuine market demand. Friends, family, and early adopters might love your product, but they aren't necessarily representative of the broader market.

The Vanity Metrics Mirage: Some startups focus on metrics that look good on paper but don't translate to real business value. High user numbers don't mean much if those users aren't engaged or paying.

The "If We Build It, They Will Come" Mirage: This is the belief that a technically superior or innovative product will automatically find its market. In reality, even great products need the right positioning, marketing, and distribution to succeed.

Now, let's dive into a real-world example that illustrates the perils of misunderstanding product-market fit.

Case Study: Quibi

Quibi, short for "quick bites," was a mobile-first streaming platform founded by Jeffrey Katzenberg and Meg Whitman. Launched in April 2020 with a staggering $1.75 billion in funding, Quibi aimed to revolutionize how people consumed content on the go with high-quality, short-form videos.

The idea seemed solid: busy millennials watching premium content in 10-minute chunks during their commutes or lunch breaks. Quibi even attracted big names like Steven Spielberg and Chrissy Teigen to create content.

However, Quibi's timing couldn't have been worse. The platform launched just as the COVID-19 pandemic hit, confining people to their homes and eliminating those on-the-go moments Quibi was banking on. Suddenly, their mobile-only approach became a liability rather than an asset.

Despite pivoting to allow TV casting and offering a generous 90-day free trial, Quibi failed to gain traction. By October 2020, just six months after launch, Quibi announced it was shutting down. They had missed the mark on product-market fit, failing to adapt quickly enough to changing consumer behaviors and preferences.

Lesson: Before you start building, make sure you're solving a real problem for real people. And always be ready to pivot faster than a ballerina in a hurricane.

2. The Cash Flow Quicksand (29% of failures) 💸

Cash flow management is the lifeblood of any business, but it's particularly crucial for startups. It refers to the movement of money in and out of your business. Poor cash flow management can sink even promising startups with great products.

Here are some key aspects of cash flow management include:

1. Revenue forecasting: SCORE, a nonprofit association supported by the U.S. Small Business Administration, offers a free sales forecast template

2. Expense tracking: Microsoft offers a variety of free Excel templates, including expense trackers

3. Burn rate calculation: While not a direct template, Investopedia provides a detailed explanation of how to calculate burn rate

4. Runway estimation: How to Calculate Your Startup's Cash Runway

To truly grasp the impact of poor cash flow management, let's examine a cautionary tale from Silicon Valley.

Case Study: Jawbone

Jawbone was once a darling of Silicon Valley, known for its stylish Bluetooth headsets and later, fitness trackers. Founded in 1999, Jawbone raised nearly $1 billion in funding over its lifetime and was valued at $3.2 billion at its peak in 2014.

Despite its early success, Jawbone's downfall came from a combination of factors, all rooted in poor cash flow management. The company consistently spent more than it earned, banking on future growth to cover its losses. They expanded rapidly into new product categories like speakers and fitness trackers, stretching their resources thin.

Jawbone's fitness trackers, while stylish, were plagued with technical issues and couldn't compete with more reliable options from Fitbit and Apple. The company poured millions into R&D and marketing, but sales couldn't keep pace with spending.

By 2016, Jawbone had stopped producing its fitness trackers but continued to sell existing inventory. They tried to pivot to clinical-grade wearables but couldn't secure additional funding. In July 2017, Jawbone entered into liquidation proceedings, having burned through nearly $1 billion in funding.

Lesson: Keep a close eye on your burn rate. Remember, it's not about how much money you raise, it's about how wisely you spend it.

From my experience working with numerous startups, I've observed that financial acumen is often a key differentiator between successful and struggling founders. It's more than just a skill—it's part of the entrepreneurial DNA.

Founders who prioritize financial understanding from day one tend to make more informed strategic decisions. They're not just aware of their numbers; they're intimately familiar with the financial pulse of their business. This doesn't mean you need to become a CPA, but having a solid grasp of key financial metrics can be transformative.

I've seen too many founders outsource financial management entirely, viewing it as a secondary concern. While delegation is important, completely hands-off approach to finances can be risky. You don't need to delve into every accounting detail, but being on top of critical financial numbers helps you make high-impact strategic decisions.

For instance, understanding your customer acquisition costs, lifetime value, and contribution margins can inform everything from your pricing strategy to your growth tactics. Knowing your burn rate and runway intimately can help you time your fundraising efforts more effectively.

Remember, as a founder, you're the ultimate decision-maker. The more financially literate you are, the better equipped you'll be to steer your startup through both calm and turbulent waters.

3. The Team Tangle (23% of failures) 🤼

Building a startup team is like crafting a complex puzzle. Each piece must not only fit but also enhance the overall picture. It's not just about individual brilliance, but about creating a symphony of talents that can weather the startup storm.

The Ingredients of a Stellar Team:

Culture: Aligning values and vision

Skill: Blending diverse talents

Adaptability: Flexibility in the face of change

Leadership: Guiding lights for the journey ahead

Behold, a tale of a startup whose team tangle led to its downfall:

Case Study: Fab.com

Fab.com's story is a cautionary tale of how rapid growth without proper management can lead to spectacular failure. Launched in 2011 as a social network for the gay community, Fab quickly pivoted to become a design-focused e-commerce site.

Initially, Fab was a runaway success. Within a year of its pivot, it had 10 million members and was valued at over $1 billion. Investor money poured in, with the company raising a total of $336 million.

However, Fab's meteoric rise was followed by an equally dramatic fall. The company went on a hiring spree, growing from 45 employees to over 700 in just two years. This rapid expansion led to a bloated organizational structure and a lack of clear direction.

Fab's charismatic CEO, Jason Goldberg, made a series of costly mistakes. He pushed for international expansion before solidifying the business model in the U.S. The company also shifted from flash sales to holding inventory, a capital-intensive move that drained resources.

The lack of experienced leadership became apparent as the company struggled to maintain its growth. By 2013, Fab was burning through $14 million per month. Despite attempts to cut costs and refocus the business, Fab couldn't recover. In 2015, what remained of the company was sold for a mere $15 million.

Lesson: Some smart hiring tips:

The Simon Sinek Question: Ask candidates, "What do you think I'll be surprised about when you join the company?" This encourages honesty about potential weaknesses.

The 30-Day Rule: After 30 days, ask yourself if you made the right hiring decision. If not, act quickly.

Cultural Add: Look for people who will add to your culture, not just fit into it.

Trust Your Gut: Your instincts about a hire are often right. Don't ignore them.

Remember, your team is your most valuable asset. Each hire is a critical decision that can significantly impact your startup's trajectory. These practices can help you build a high-performing, cohesive team capable of driving your startup towards success.

4. The Competition Crush (19% of failures) 🥊

Many startups underestimate the impact of competition or fail to differentiate themselves effectively. Here are the top 3 competitive pitfalls:

The Ostrich Syndrome: Ignoring competitors and assuming your product is unique.

The Copycat Trap: Trying to be everything to everyone instead of carving out a unique niche.

The Price War Pitfall: Engaging in unsustainable price competition instead of focusing on value.

Let's look at a real-world example of a promising startup that found itself out manoeuvred by more aggressive competitors.

Case Study: Sidecar

Sidecar, founded in 2011, was actually a pioneer in the ride-sharing industry. They introduced several innovative features that are now standard in the industry, such as ride-sharing (multiple passengers splitting the cost of a ride) and driver destination (allowing drivers to pick up riders heading in the same direction).

Despite its early mover advantage and innovative features, Sidecar found itself outmaneuvered by Uber and Lyft. These competitors had deeper pockets and were able to expand more aggressively, often operating at a loss to gain market share.

Uber and Lyft's aggressive expansion strategies and price wars made it difficult for Sidecar to compete. They couldn't match the driver incentives or passenger discounts offered by their better-funded rivals. As a result, Sidecar struggled to attract and retain both drivers and riders.

By 2015, despite raising $35 million in funding, Sidecar couldn't keep up with the pace of growth set by Uber and Lyft. They attempted to pivot to delivery services, but it was too little, too late. In December 2015, Sidecar shut down its operations and sold its assets to General Motors.

Lesson: Don't just run the race, change the game. Focus on your unique value proposition and keep innovating.

5. The Pricing Puzzle (18% of failures) 🧩

Pricing is a delicate balance between perceived value, market demand, and profitability. Here are the top 3 pricing pitfalls:

The Race to the Bottom: Pricing too low in an attempt to gain market share, leading to unsustainable operations.

The Premium Presumption: Overpricing based on perceived value without validating willingness to pay.

The Fixed Mindset: Failing to adjust pricing strategy based on market feedback and changing conditions.

To understand the complexities of pricing strategy, let's examine a case study that shook the movie industry.

Case Study: MoviePass

MoviePass, founded in 2011, aimed to disrupt the movie theater industry with a subscription-based model. The service allowed subscribers to watch a movie a day in theaters for a monthly fee. Initially priced at $30-$50 per month, MoviePass struggled to gain widespread adoption.

In August 2017, the company made a bold move: they dropped their price to $9.95 per month. This pricing strategy was based on the gym membership model, betting that most subscribers wouldn't use the service frequently enough to make it unprofitable.

The price drop led to explosive growth. MoviePass went from 20,000 subscribers to over 3 million in less than a year. However, this growth came at a steep cost. The company was losing money on almost every subscriber who saw more than one movie per month.

MoviePass tried various strategies to stem their losses: surge pricing, limiting access to popular movies, and even briefly reactivating canceled subscriptions without user consent. These moves angered subscribers and damaged the brand's reputation.

Despite attempts to pivot and change their model, MoviePass couldn't find a sustainable path forward. The company shut down in September 2019, having burned through hundreds of millions of dollars. Their parent company, Helios and Matheson Analytics, filed for bankruptcy in January 2020.

Lesson: Price based on value, not just cost. And always have a sustainable business model behind your pricing strategy.

6. The User-Unfriendly Trap (17% of failures) 🕳️

A great product is useless if users can't figure out how to use it. Here are the top 3 user experience mistakes:

The Feature Overload: Adding too many features, making the product complex and difficult to navigate.

The Design Disconnect: Creating an interface that looks good but doesn't align with user needs or expectations.

The Feedback Fallacy: Ignoring user feedback or failing to implement improvements based on user insights.

To illustrate the importance of user experience, let's delve into a case where a major redesign backfired spectacularly.

Case Study: Snapchat's 2018 Redesign

In early 2018, Snapchat rolled out a major redesign of its app. The goal was to separate "social" from "media," making the app more appealing to advertisers and easier for new users to understand. However, this redesign turned into a cautionary tale about the dangers of ignoring user preferences.

The new design drastically changed the app's layout. It separated content from friends and publishers, and introduced a new algorithm-based feed. The intention was to make the app more intuitive, but for millions of loyal Snapchat users, it felt like their favorite app had suddenly become foreign and difficult to navigate.

The backlash was immediate and severe. Users complained that the new design was confusing and made it harder to find their friends' stories. A Change.org petition to remove the update garnered over 1.2 million signatures. Even celebrities like Kylie Jenner criticized the redesign, tweeting "sooo does anyone else not open Snapchat anymore? Or is it just me... ugh this is so sad." This tweet alone was associated with a $1.3 billion drop in Snapchat's market value.

The impact on Snapchat's business was significant. In Q2 2018, Snapchat reported its first-ever decline in daily active users, losing 3 million users. The company's stock price plummeted, and growth stagnated.

Snapchat eventually backtracked, rolling out another redesign that brought back some of the old features. However, the damage was done. The incident highlighted the importance of user experience and the risks of making drastic changes without proper user testing and feedback.

Lesson: Keep it simple, stupid (KISS). And always, always listen to your users.

7. The Pivot Paralysis (10% of failures) 🔄

Sometimes, the original business model doesn't work out and a pivot is necessary. Here are the top 3 pivot problems:

The Sunk Cost Fallacy: Refusing to change direction due to resources already invested.

The Indecision Spiral: Constantly changing direction without giving any strategy enough time to work.

The Identity Crisis: Losing sight of core values and strengths during a pivot.

To see the consequences of failing to pivot effectively, let's examine the fall of a once-dominant industry leader.

Case Study: Blockbuster

Blockbuster's fall from grace is a classic example of a company failing to adapt to changing market conditions. At its peak in 2004, Blockbuster had over 9,000 stores worldwide and was valued at $5 billion.

The writing was on the wall for Blockbuster as early as 1997 when Reed Hastings founded Netflix. Initially a DVD-by-mail service, Netflix offered a more convenient alternative to Blockbuster's brick-and-mortar model. Blockbuster had the opportunity to buy Netflix for $50 million in 2000 but passed on the deal, seeing Netflix as a niche service.

As broadband internet became more widespread, Netflix pivoted to streaming in 2007. Blockbuster, still committed to its physical stores, was slow to react. They didn't launch their own DVD-by-mail service until 2004 and didn't enter the streaming market until 2008.

By the time Blockbuster realized the threat, it was too late. They were saddled with expensive leases on their retail locations and couldn't match Netflix's technology or content library. Attempts to diversify, like acquiring Circuit City in 2008, failed to gain traction.

Blockbuster filed for bankruptcy in 2010 and was bought by Dish Network in 2011. By 2014, all corporate-owned stores had closed. The once-dominant video rental chain had become a cautionary tale of what happens when a company fails to innovate and adapt to changing consumer preferences.

Lesson: Stay flexible. Be ready to change direction faster than a weathervane in a tornado.

8. The Scaling Screw-up (74% of failures) 📈

Scaling too quickly or inefficiently can lead to spectacular failures. Here are the top 3 scaling mistakes:

The Premature Expansion: Scaling before the business model is proven and stable.

The Infrastructure Oversight: Failing to build systems and processes that can handle rapid growth.

The Culture Dilution: Losing the company culture and values in the rush to expand.

Let's explore a case study that demonstrates how rapid scaling without a solid foundation can lead to a startup's downfall.

Case Study: Beepi

Beepi, an online used car marketplace, was founded in 2013 with the goal of revolutionizing the way people buy and sell used cars. The company offered a peer-to-peer platform where sellers could list their cars, and Beepi would handle the rest - inspections, pricing, photography, and delivery to buyers.

Initially, Beepi saw rapid growth and attracted significant investor interest. They raised over $60 million in their Series B funding round in 2014. Flush with cash, Beepi began an aggressive expansion plan. They aimed to be in 16 U.S. cities by the end of 2015 and 80 by the end of 2016.

However, this rapid expansion came at a cost. Beepi's overhead skyrocketed as they hired aggressively and leased large offices in prime Silicon Valley real estate. The company was reportedly burning through $7 million a month at its peak, with a significant portion going to salaries and perks for its ballooning workforce.

Beepi's business model also proved challenging to scale. The company took possession of cars that didn't sell within 30 days, leading to an inventory buildup. This capital-intensive approach put a strain on the company's finances.

Despite raising nearly $150 million in total funding, Beepi couldn't achieve sustainable growth. When attempts to raise additional funding or find a buyer failed, the company was forced to shut down in December 2016. The assets were sold off to satisfy creditors, leaving no value for investors.

Lesson: Grow at a pace you can manage. Make sure your foundations are solid before you start building skyscrapers.

9. Lack of Investor Influence (13% of failures) 💼

Investors can provide more than just capital. Here are the top 3 investor-related issues:

The Mismatch Dilemma: Partnering with investors who don't align with the company's vision or goals.

The Expertise Vacuum: Failing to leverage investors' knowledge and networks.

The Autonomy Imbalance: Giving up too much or too little control to investors.

To understand the impact of investor decisions, let's examine a case where misalignment led to significant losses.

Case Study: Good Technology

Good Technology, a mobile security startup, was once a rising star in Silicon Valley. Founded in 1996, the company pivoted several times before finding its niche in enterprise mobile security and management.

By 2014, Good Technology was doing well. They had over $200 million in revenue, were expanding rapidly, and filed for an IPO. The company was valued at $1.1 billion in its last private funding round.

However, the IPO plans were delayed due to unfavorable market conditions. During this period, BlackBerry approached Good Technology with an acquisition offer of $825 million. The board, primarily composed of venture capital investors, rejected the offer, believing the company could fetch a higher price.

This decision proved to be a costly mistake. Good Technology's financial situation deteriorated rapidly in the following months. They struggled with high costs and increasing competition. When BlackBerry came back with another offer in 2015, it was for just $425 million - nearly half of their previous offer.

The acquisition at this lower price caused significant losses for employees, many of whom had been compensated with stock options. Some faced tax bills on stocks that were now worth much less than when they were granted.

The case highlighted the potential misalignment of interests between venture capital investors, who can afford to take bigger risks, and employees, who often have much of their net worth tied up in company stock.

Lesson: Choose your investors wisely. Look for partners who share your vision and can provide more than just money.

10. The Burn-out Breakdown (8% of failures) 🔥

Founder and team burnout can derail even the most promising startups. Here are the top 3 burnout risks:

The Workaholic Trap: Believing that working longer hours always leads to better results.

The Isolation Island: Neglecting personal relationships and support systems.

The Perfectionist Paralysis: Setting unrealistic standards and being unable to delegate.

Let's conclude with a case study that highlights the personal toll of startup life and the importance of sustainable growth.

Case Study: Meerkat

Meerkat, launched in February 2015, was a mobile app that allowed users to stream live video to their Twitter followers. It quickly became a sensation, gaining over 100,000 users in its first month and becoming the talk of the SXSW festival that year.

The app's success caught the attention of Twitter, which quickly acquired and relaunched a competing app, Periscope. Suddenly, Meerkat found itself in a David vs. Goliath battle with Twitter's full weight behind its competitor.

Ben Rubin, Meerkat's founder and CEO, led an intense effort to compete with Periscope. The company worked around the clock to add features and grow its user base. However, when Twitter cut off Meerkat's access to its social graph, it became increasingly difficult for Meerkat to grow.

The stress of competing with a tech giant took its toll. In an interview, Rubin admitted, "It was a year of constant competition, and we were just drained." The team was exhausted, working long hours with the constant pressure of trying to outmaneuver a much larger competitor.

By March 2016, just a year after its explosive launch, Meerkat pivoted away from live streaming. Rubin announced that the company was shifting focus to a new product, a group video chat app called Houseparty.

While Houseparty found some success (and was eventually acquired by Epic Games in 2019), the original Meerkat product was shuttered. The rapid rise and fall of Meerkat serves as a reminder of the intense pressure startup founders face and the toll it can take.

Lesson: Take care of yourself and your team. You can't pour from an empty cup, so make sure to refill regularly.

Now that we've explored the pitfalls, let's equip ourselves with some powerful tools and turn our attention to survival strategies. Next up, we'll explore how startups can avoid the fate of those we've studied and thrive in the challenging world of entrepreneurship.

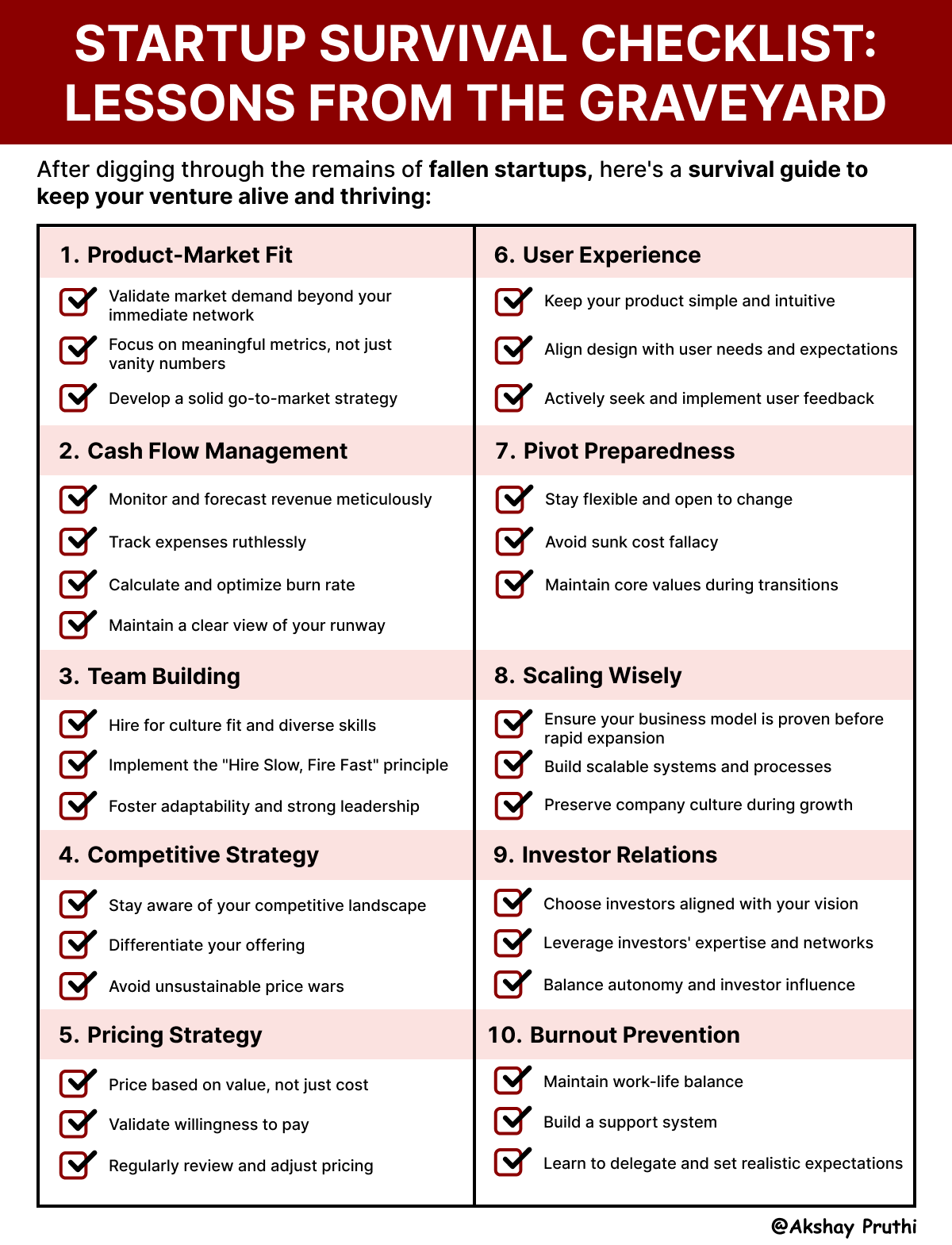

How Not to Die As A Startup? 💪

The "Default Alive" Lifeline Make sure your growth and spending get you to profitability before you run out of cash. It's like making sure you have enough fuel to reach your destination before taking off.

The Lean Startup Methodology Build, measure, learn. Repeat. It's like being a scientist, but instead of lab coats, you wear hoodies.

The "Do Things That Don't Scale" Approach In the early days, get your hands dirty. Airbnb founders went door-to-door taking photos of listings. It's not glamorous, but it works.

The "Cockroach Startup" Mindset Be resilient, adaptable, and hard to kill. Like actual cockroaches, but less gross and more profitable.

The "Fail Fast, Learn Fast" Philosophy Embrace failure as a learning opportunity. It's like falling off a bike - the more you do it, the better you get at avoiding it (and the cooler your scars become).

Having identified the potential pitfalls, it's time to dive into proven frameworks that can empower startups to navigate challenges and achieve success

These tools have been battle-tested by successful companies and can guide you in avoiding the pitfalls we've discussed.

Frameworks for Startup Success

1. 🖼️The Business Model Canvas

The Business Model Canvas, developed by Alexander Osterwalder, is a strategic management tool to develop new business models or document existing ones. It's a visual chart with elements describing a firm's value proposition, infrastructure, customers, and finances.

Successful Example: Airbnb Airbnb used the Business Model Canvas to refine their model. They identified their key value propositions (unique stays, local experiences) and customer segments (travelers seeking alternatives to hotels). This clarity helped them focus on what mattered most to their users and scale effectively.

How to use it:

Map out your entire business on one page

Identify gaps in your business model

Use it as a tool for brainstorming and strategic discussions

2. 🍚The RICE Prioritization Framework

RICE stands for Reach, Impact, Confidence, and Effort. It's a scoring system to help teams prioritize ideas objectively.

Successful Example: Spotify Spotify uses the RICE framework to prioritize product features. This helped them focus on high-impact projects like personalized playlists and podcast integration, which significantly boosted user engagement and retention.

How to use it:

Score each potential project or feature on the four RICE criteria

Calculate a final score to compare ideas objectively

Use the scores to create a prioritized roadmap

3. 🏴☠️The AARRR (Pirate Metrics) Framework

AARRR stands for Acquisition, Activation, Retention, Referral, and Revenue. It's a customer-lifecycle framework that helps startups focus on metrics that matter.

Successful Example: Dropbox Dropbox used the AARRR framework to grow its user base exponentially. They focused heavily on referrals, offering extra storage for users who invited friends. This strategy led to a viral growth loop that helped Dropbox become a unicorn.

How to use it:

Define key metrics for each stage of the customer lifecycle

Use these metrics to identify where you're losing customers

Focus your efforts on improving the weakest parts of your funnel

4. 👷♀️The Jobs-to-be-Done Framework

This framework focuses on understanding the "job" that customers are "hiring" your product to do. It helps teams focus on customer needs rather than product features.

Successful Example: Intercom Intercom used the Jobs-to-be-Done framework to understand why customers were "hiring" their product. This insight helped them refine their messaging and product development, leading to rapid growth and a $1.3 billion valuation.

How to use it:

Identify the core "jobs" your customers are trying to accomplish

Align your product development and marketing with these jobs

Use customer interviews to uncover unmet needs and potential new jobs

5. 📊The Lean Canvas

The Lean Canvas is a variation of the Business Model Canvas, adapted for startups. It focuses on problems, solutions, key metrics, and competitive advantages.

Successful Example: Buffer Buffer, the social media management tool, used the Lean Canvas to iterate on their business model quickly. They were able to validate their ideas rapidly and pivot when necessary, leading to sustainable growth.

How to use it:

Fill out the canvas with your initial hypotheses

Test each hypothesis with minimal viable products (MVPs)

Iterate based on what you learn, updating the canvas as you go

And there you have it! Our archaeological expedition through the ruins of failed startups is complete.

Quick Summary of the action items we've explored:

The "Default Alive" Lifeline: Ensure your growth and spending lead to profitability before running out of cash.

The Lean Startup Methodology: Embrace the build-measure-learn cycle for rapid iteration and improvement.

The "Do Things That Don't Scale" Approach: Get hands-on in the early days to truly understand your customers and product.

The "Cockroach Startup" Mindset: Cultivate resilience and adaptability to weather tough times.

The "Fail Fast, Learn Fast" Philosophy: View failures as learning opportunities to refine your approach.

Remember, there's no one-size-fits-all solution in the startup world. Your path to success may involve a unique combination of these strategies or even developing your own approach. The key is to find what works best for your specific situation, team, and market. Don't be afraid to experiment, mix and match these strategies, and forge your own path to success.

Success in startups is all about having a great idea, the right team, perfect timing, and the perseverance of a bulldog chewing on a brick. Keep learning, keep adapting, and always, always focus on solving real problems for your customers. 💡🤝⏱️

Until next time, keep digging for those startup treasures! 🗺️💰

Akshay

P.S. If you found this newsletter helpful, don't forget to share it with your fellow startup archaeologists.